2005 MDDC Press Association Awards - 1st Place Public Service

Check out Part II in the award-winning series and continuing coverage:

Scammed Out of House and Home

MD woman falls victim to growing real estate scam

The Daily Record (Baltimore, MD)

March 4, 2005 Friday

Copyright 2005 Dolan Media Newswires

Section: NEWS; General news

Length: 1732 words

Byline: Kathleen Johnston Jarboe

Body

Editor's note: This part one of a two-part series. Part two, which explores the laws being exploited and the legislative effort to change them, will appear next Friday.

Helen Cheeks' determination propelled her from welfare and the projects to a four-bedroom townhouse in Prince George's County. But street smarts and a strong will didn't save her home from a crafty real estate investor.

One night three months ago, when Cheeks still lived in her townhouse, she tried to sort out how someone who promised to help her keep her home out of foreclosure ended up with the title. She says she never received a dime of the $165,000 purchase price listed on land records.

The 48-year-old spread papers across the couch. They didn't all fit. So she continued arranging them on the floor. She keeps the documents in a few manila folders. There are court notices, receipts, police complaints, attendance charts, letters and other items.

Cheeks isn't sure what to make of them. Somewhere in the stack there must be an answer. There must be a hint.

"I guess I really can't come to the grips of how this really went on," she said later.

Cheeks knows this: She fell behind on her mortgage payments in late 2003. Then she received literally hundreds of solicitations from businessmen offering to help. "There are programs available where you do not have to pay the money back," states one letter she still has.

The situation grew more confusing after she contacted one of her callers for help.

How it works

Her case could bring criminal charges in what many consider a growing scam made possible by soaring home values.

Even though Cheeks was falling behind on her payments, she was building equity in her home. She had about $60,000 in equity in her home when she unwittingly became a target for what some lawmakers, prosecutors and regulators call equity skimming or foreclosure rescue cons.

The alluring promises to save homes appear just as homeowners are most desperate. Skillful real estate investors scan public postings for those in danger of foreclosure. Then they call, knock or mail fliers to the homeowners.

Prince George's prosecutors are looking at charging some investors with criminal counts, including the man who acquired Cheeks' property. Because no charges or lawsuits have been filed in this case, The Daily Record will not identify the investor Cheeks accuses of defrauding her. The investor did not return phone calls for comment for this story.

"Maybe [homeowners] can't afford [their houses]. But they should get the appreciation on the property, and someone shouldn't be able to walk in and get it from them with shady promises and fast talk," said Doyle L. Niemann, a Prince George's assistant state's attorney focused on economic crimes and a state delegate.

Unscrupulous investors allegedly swipe homes through a number of methods. It usually starts with a stack of papers, the pressure of a pending foreclosure and phony promises. Investors rush the homeowner to sign papers. Buried within could be a power of attorney document, allowing another to make decisions about a property without the homeowner's presence, or a quit claim deed, changing the name on the title without requiring a formal settlement.

Often the deals are accompanied by a loose and unspecified agreement that the homeowner can rent, lease or eventually buy back the property. But the arrangement is often structured to ensure default.

Plans A & B

Cheeks, a federal police officer, jumped from document to document in December to tell her story.

She didn't have them all initially, like the papers she signed for the investor's lawyer in August. The lawyer didn't provide her with copies. Those August papers stand out in her mind.

The first time she dealt with the investor, he told Cheeks to call a legal associate to get on a monthly Chapter 13 repayment plan. But she couldn't afford it.

"It was hectic," she said of the first plan. "I couldn't pay no utilities."

The investor's second suggestion eventually involved the August meeting: Wait for my lawyer to contact you. Then dismiss all your creditors by filing a Chapter 7 bankruptcy, Cheeks recalled.

Last summer Cheeks waited like she was told. Weeks passed. When the investor's associate finally contacted her, it was an unannounced visit at work. Cheeks had to get permission to leave a training class to speak with him.

She didn't read the documents the lawyer brought. The man said the papers pertained to the bankruptcy filing. "I didn't have a lot of time and [the lawyer] knew it," she said.

The August papers are the only ones Cheeks recalled signing that summer. But in a court filing he made, the investor claims to have acquired the house in July.

Cheeks gets angry about the court papers. The investor filed four trespassing cases against her and her husband Anthony in October.

One case claims her husband threatened the investor on a day and time her husband was at job training. Anthony's attendance sheet at the A-men! The Anacostia Men's Employment Network is another document Cheeks has in her paper puzzle.

State regulators helped Cheeks dismiss most of the cases. But everybody missed a fourth suit the investor filed seeking $4,500 in alleged damages. A judge granted the investor's motion in November when Cheeks failed to show for trial.

Swindles growing?

State and local officials, among others, believe this type of alleged swindle is growing.

"It's being fueled by the tremendous equity people are building. The housing market is going crazy," said Scott C. Borison of Legg Law Firm LLC in Frederick. Borison has pursued cases related to the scam for more than a dozen clients in the past year. He said he receives calls almost daily about the issue.

Market forces have helped. Prince George's County homes bought in January sold on average for 27 percent more than they did a year ago, according to Metropolitan Regional Information Systems Inc. of Rockville. The year before the average sale price increased by nearly 21 percent.

"Pay five or seven grand to catch up the mortgage and now you're a claimant to $100,000 of equity," Borison said.

It is unclear how many people have educated themselves in the intricacies of complex real estate laws to manipulate the system. Many officials blame the get-rich-quick real estate seminars and books.

Spokesmen such as Carleton Sheets promise late-night television watchers that they can quickly achieve affluence with a few simple real estate deals. Sheets' Web sites, ads and instructional materials carry countless last-nameless student success stories, like those of Lisa P. and Brett J. Both claim to have netted more than six figures in property deals.

The course materials, produced by the Professional Education Institute of Burr Ridge, Ill., give buyers ideas about how to buy real estate with no money down. It suggests beginning investors can produce skyrocket profits by seeking deals from financially distressed homeowners and owners of neglected homes.

A California real estate writer compares most individuals peddling get-rich-quick plans to snake oil salesman.

"Just about everybody knows someone who made money in real estate so the notion that you can get rich quick in real estate is a plausible scenario to laymen," said John T. Reed, editor of Real Estate Investor's Monthly in Alamo, Calif. "I think the people who teach it probably taught the bad guys. But I don't think the people who teach it are interested in getting their hands dirty in real estate."

Reed said it is possible to buy real estate with no money down. But the methods are advanced and tricky.

There also are ways to buy pre-foreclosure properties ethically, according to Reed.

"Understand you're sitting across the table from people on the rocks and all they have left is equity," Reed said. "Don't lie and tell them you're giving market value."

"Don't portray the offer as the best [possible]," Reed continued. "The whole reason for this [deal] is to buy the house for less than it is worth."

"I've never done it," Reed said. "I just couldn't stomach it."

Another adviser cautions vulnerable homeowners about entering into any deal under duress.

"If you're going to do a deal where you're going to lease back, make sure to go to a settlement agent. Don't just do a deal in your living room. Make sure you're actually selling," said Frank Stickle, president of American Mortgage Assistance Inc. in Falls Church, Va. Stickle counsels financially troubled homeowners.

What now?

Cheeks now resides in a two-bedroom apartment in Landover. It's cramped even though she rushed to give away two sets of bedroom furniture before the move. She was kicked out of her townhouse just days after Christmas.

Even this past December as she stared at her document puzzle, she knew that eviction was a possibility.

"This is what [the investor] does. He preys on people he thinks is vulnerable," she said. "If I die tomorrow, I'll still be fighting. Somebody somewhere is going to hear my cry and help me."

She sat with her legs crossed, sucking a cigarette. She questioned what her gullibility meant about her.

Before moving to Capitol Heights, she lived in the projects for more than two decades. She wanted something better for her three boys -- a quiet neighborhood, a nearby recreation center, distance from the drugs and gun violence of Clay Terrace NE in Washington, D.C.

"I saved up all my little monies," she said. After three years, she had enough for a small down payment and closing costs. Then the mother and grandmother who once lived off welfare rolls bought her first home.

"It is a lot of painful memories," Cheeks said. "To see how far I came. " But then on the other hand to ask myself if this is still another failure?"

At this point, her husband Anthony uttered what for him is one of the few sure things he knew about the events that happened to them.

"She is not a failure because she has not looked at all she's accomplished," Anthony Cheeks said. "I hope she knows I'm proud of her no matter what happens."

HOME PRICES SOARING

Home values increased throughout Maryland last year. Here's just how much.

Anne Arundel: 7.4 percent

Baltimore City: 36 percent

Baltimore County: 17.3 percent

Calvert: 20.9 percent

Carroll: 13.5 percent

Charles: 37 percent

Frederick: 26.9 percent

Harford: 22.5 percent

Howard: 22 percent

Montgomery: 15 percent

Prince George's: 27.4 percent

Saint Mary's: 32.3 percent

Source: Metropolitan Regional Information Systems Inc.

Load-Date: March 4, 2005

2005 MDDC Press Association Awards - 1st Place Public Service

Part II in Series

Marylanders Duped Out of Their Homes

Duped out of their homes by foreclosure rescue scams, Marylanders get little help from the state

The Daily Record (Baltimore, MD)

March 11, 2005 Friday

Copyright 2005 Dolan Media Newswires

Section: NEWS; Financing

Length: 1718 words

Byline: Kathleen Johnston Jarboe

Editor's note: This is part two of a two-part series.

Lawrence wanted to shower after his first deal on the job. Lawrence had never done a foreclosure deal before. But the contract that made a Pasadena woman a tenant in her own property didn't sit right.

The hastily arranged meeting occurred in a print shop just one day before the woman would lose her home. For a $7,000 loan to stop foreclosure, the woman signed over her title, consented to become a renter, agreed to pay twice her old mortgage bill until the rest of her late payments were repaid and became liable to pay back $17,000 plus interest for the original loan.

The woman hugged Lawrence and his boss, Loren J. Williams. She thanked God they visited her, according to Lawrence.

"Really, that was a sad deal," he said.

Later the woman sued them, claiming the pair misled her.

Lawrence declined to say more about the woman. But the man who found foreclosure investment leads for Williams claimed his boss often twisted deals Lawrence first presented to homeowners.

Yet Lawrence continued to work for Williams and his wife, Abbey. They were friends, after all. And the couple seemed to be successful. They kept buying more Rolls-Royces, he said. They dined at the finest restaurants.

"[Williams] just kept tapping me on the shoulder, saying, 'Don't worry about it. I know what I'm doing,'" Lawrence said.

Williams was right, partly. Even though many of his dealings mirror what state officials have started calling foreclosure rescue scams, current law provides consumer attorneys and prosecutors with few tools to fight the practice.

"These deals are not necessarily illegal as much as they are unconscionable," said Frank Stickle, president of American Mortgage Assistance Inc. in Falls Church, Va. Stickle advises financially troubled homeowners and warns homeowners of foreclosure rescue offers.

Victims of the alleged fraud usually claim they thought they were getting a loan. Unprincipled investors offer little explanation about the papers being signed and rush homeowners to sign. Sometimes there are just hours before the home will go to auction in foreclosure.

Deals are typically structured to ensure the property owner defaults on any loans. Then the shady investors swipe the homeowner's last asset: the equity in their home as housing prices have soared.

Law enforcement tends to shrug off the cases that fall in a gray area between criminal and civil charges.

Pursuing the cases civilly is complicated, costly and can divide victims between two court systems.

Homeowners wanting to regain a swindled deed have to file suit in circuit court. Meanwhile the real estate investor who took the home could move to evict or press trespassing charges in district court, which doesn't consider how the property was obtained when ruling. Pricey bonds are required to delay the motions.

"Civil court is not user-friendly for a person with financial problems. People don't know their rights," said Doyle L. Niemann, an assistant state's attorney for economic crimes in Prince George's County and a state delegate.

Finding a lawyer is also difficult.

"Practically, the people coming to you can't really afford to pay you. The other problem is a lot of these [real estate investors], who knows what they have [in assets] if anything. If you do recover, are you going to get money eventually?" said Scott C. Borison of Legg Law Firm LLC in Frederick. Borison has represented several foreclosure rescue victims, including the Pasadena woman, Barbara J. Staples. "I'm proceeding on the basis that eventually I'll figure out how to get the money."

On his own

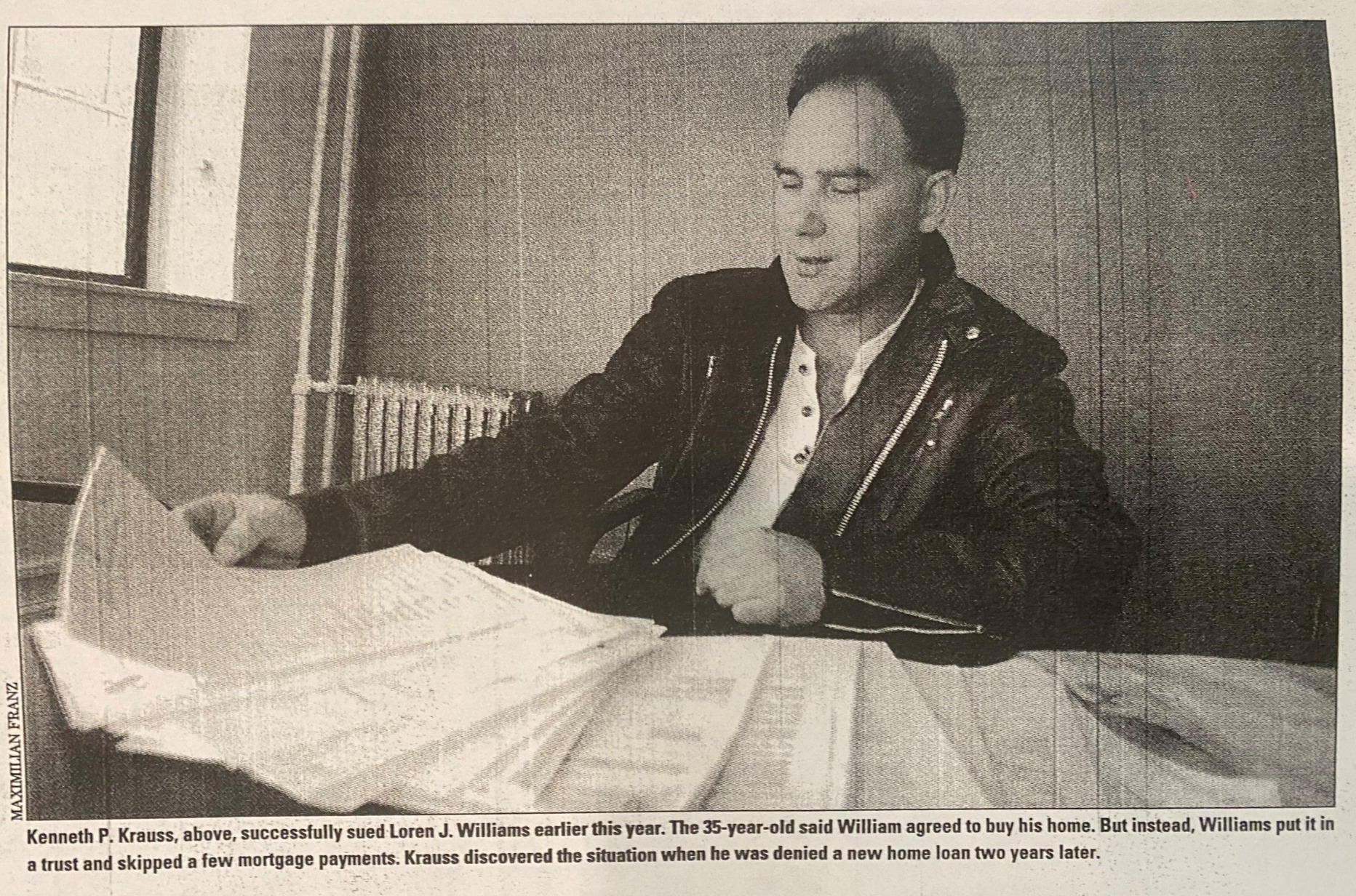

Kenneth P. Krauss was luckier than many of Williams' past clients. The 35-year-old wasn't selling his home under duress in 2000 when he met the investor. He found Williams through the phonebook. A full-page ad said Williams' business bought, sold and managed properties.

Kraus wanted to sell his home quickly and move. Williams agreed to buy the home, according to Krauss. The transaction seemed complete.

Instead of purchasing the property though, Williams put it in a trust and skipped a few mortgage payments. Krauss discovered the deceit when he was denied a new home loan two years later.

Three lawyers refused to take his case. The reason was always the same: It'll take two years, cost $5,000 to $10,000 and we can't promise a positive result.

So Krauss started investigating Williams on his own. The home improvement contractor learned how to search court records, property titles and even hired private detectives for small tasks. Over two years, he collected 500 pages of documents and identified almost two dozen alleged victims of Williams.

Most had dealt with Williams as their house went to foreclosure, like Staples.

Another sorry customer included the woman who planned to buy Krauss' Millersville home in 2002. With promises from Williams that there would be no problem with the purchase, she sank $15,000 of repairs into the home, according to Krauss. She begged Krauss to sign off on the deal once a title company raised red flags. The company barred Williams from selling the home without Krauss' approval after spotting a questionable name change in trust papers.

"What motivated me was people like her, Barbara " all the women that cried to me and said their life was ruined. Because every day I knew [Williams] was looking for people like Barbara," Krauss said about his growing hobby.

Barbara Staples eventually aided in Krauss' investigation. Staples declined to comment for this story due to a gag order she agreed to after settling her case with Williams. The Daily Record obtained information about Staples from court records and interviews with Lawrence and Krauss.

Krauss had lots of evidence against Williams, he believed, starting with deals he considers unethical at best and minor violations that should have shut down his companies at worst.

The minor violations eat at Krauss. He's not sure how many real estate businesses Loren and Abbey Williams have registered in their names. But all the companies Krauss has found share the same address: 2315B Forest Drive #49 in Annapolis. The location isn't an office building. It's a Parcel Plus box.

The address makes it very difficult to serve lawsuits to Williams' Annapolis Land & Property Management Ltd. It is also against Maryland law to register a business without a physical address. Forfeiture of one's business license is supposed to be the penalty, according to officials at the Maryland State Department of Assessments and Taxation.

But Annapolis Land & Property Management and a company registered to Williams' wife continue to hold licenses to do business.

Krauss and Staples took their research to the FBI, a state's attorney in Virginia, the state's attorney in Annapolis, Maryland's attorney general, the Maryland Real Estate Commission and the state Department of Assessments and Taxation.

No one did anything.

"The state allowed him to get away with this, that is how [Williams] flourished. There is only so much the average citizen can do," Krauss said.

Economic crime cases are known to take much longer to investigate than other crimes. The cases require extensive paper chases for obscure documents and lots of interviews. A spokeswoman for the state's attorney in Annapolis said her office gets at least a dozen calls a day from citizens wanting an activity investigated.

Annapolis action

Still some state officials have begun to take notice of the growing foreclosure rescue business.

While there are legitimate real estate investors who invest in foreclosure properties, legislators worry there are not enough consumer protections against the scoundrels of the business. This year lawmakers in Annapolis introduced a bill to regulate the niche and set criminal penalties for violating the proposed measure. Minnesota recently passed a similar measure.

"This is new territory. " Traditionally the criminal law was reluctant to get involved in disputes over property contracts. For the participants, every contract dispute is a crime," said Del. Doyle L. Niemann.

A 2005 court ruling for Krauss and against Williams was spurred by growing recognition of the issue. Krauss won $43,000 in compensatory damages and $250,000 in punitive damages after he eventually secured a lawyer.

The judge said he wanted to send a message.

"There appear to be folks who are looking to swoop down and take advantage of property owners in this county," said Judge Paul G. Goetzke about his ruling in Anne Arundel County Circuit Court. "The facts of this case called especially for a substantial award of punitive damages to deter this kind of behavior in the county and to punish this particular wrongdoer."

But in many cases, the odds are stacked against homeowners.

Already short on cash, Staples had to pay a $4,095 bond to delay eviction when Williams filed charges against her for missing rent bills.

And the documents signed just hours before foreclosure can be hard to ignore in court. Williams claimed the $17,000 promissory note Staples signed in exchange for her $7,000 loan was just a guarantee. His business needed to recoup something if the landlord/tenant contract that accompanied the loan wasn't recognized, according to court papers.

Lawrence, who has also been sued with his boss in several civil suits, said the Williamses learned to use the courts as a weapon.

Lawrence knows from personal experience. Williams' wife Abbey filed a police complaint against him for extortion last August. He claims the complaint stemmed from a request for the $20,000 he says the couple owed him.

"It was just something for them to hold over my head," Lawrence said.

"That's what Loren would do. " He'd go after the weak, the hurting, the poor and then he'd nail them," Lawrence said. "He'd try to get something on everyone so he could manipulate him."

Abbey Williams did not return calls for comment on this story.

Today Loren Williams sits in an Anne Arundel jail -- but not for real estate fraud. He's charged with sex offenses against boys.

Krauss is happy that Williams can't buy more properties for now. But the Eastern Shore man who worked for years to stop Williams' real estate businesses finds it disturbing, too.

If it weren't for the sex crimes, he'd still be ripping people off today, he said.

Load-Date: March 11, 2005

Duped out of their homes by foreclosure rescue scams, Marylanders get little help from the state

Continuing coverage from award-winning story about mortgage foreclosure rescue scams.

Md Foreclosure Bill Advances

MD foreclosure bill draws industry ire

The Daily Record (Baltimore, MD)

February 23, 2005 Wednesday

Copyright 2005 Dolan Media Newswires

Section: NEWS; Government activity

Length: 529 words

Byline: Kathleen Johnston Jarboe

Banking and real estate groups yesterday objected to parts of a measure that would impose regulations and criminal penalties on a real estate niche known as foreclosure rescue.

The comments came during a meeting organized by lawmakers to gather support for the proposal and get feedback on the bill.

Rising numbers of homeowners have complained in the past year of investors promising to save them from foreclosure, only to trick them into signing away their home.

The alluring promises appear just as a homeowner is most desperate. Real estate investors scan public postings for those in danger of foreclosure. Then they call, knock or mail fliers to the homeowners.

In some Maryland neighborhoods, car windshields and telephone pools are papered with the ads. Many offers contain false promises of relief.

Prosecutors in Prince George's County are considering filing criminal charges against some of the alleged perpetrators. But lawmakers said the solution needed to be broader.

"Fixing it one by one wouldn't solve the problem," said Del. Doyle Niemann, D-Prince George's County. Niemann and Sen. Brian E. Frosh, D-Montgomery, have sponsored the bills. Niemann is also an assistant state's attorney for Prince George's County.

But John J. Harrison, a broker with Main Street U.S.A. in Upper Marlboro, said, "We're already regulated."

The measure was based on a recently passed Minnesota law aimed to curb shady real estate deals.

The bill would move what was once considered a civil matter into the criminal realm and add regulations to the business.

Lenders pursuing foreclosure would have to warn consumers that they could be approached by people promising to save their home.

The bill would also bar foreclosure specialists from making misleading statements, such as portraying themselves as an adviser or a person who could save the consumer's house.

Deals that involved transferring the property to a foreclosure specialist would have to contain disclosures in bold print about the risk of losing one's home, and offer consumer protection numbers to call for advice.

Consumers could have 10 days to rescind the deal. And if the property was sold within 18 months, the consumer would be entitled to 82 percent of the net proceeds.

Violations of the statute could carry a three-year jail sentence and $10,000 fine on top of damage awards.

Lawyers and nonprofit agencies were excluded from the description of a foreclosure specialist, but not licensed real estate agents or bankers. Realtor and banking groups complained that the definition was too broad.

The industry representatives also complained about a provision that would limit so-called foreclosure specialists from charging more than 8 percent interest on monies lent before a deal was rescinded.

The arbitrary limit could drive some lenders out of the market, said Seth M. Rotenberg, a lawyer with the firm of Gordon Feinblatt in Baltimore, representing the Maryland Bankers Association.

Consumer advocates disagreed.

"I don't know that there are any legitimate lenders [approaching the distressed home owners]," said Diane Cipollone, director of research at the Community Law Center. Only loan sharks do such deals, she added.

Load-Date: February 23, 2005